It often seems that Chinese consumers are somehow wired differently than their counterparts in other countries. When it comes to the purchase decision-making journey, we do see some truth to this. In early 2016, we spoke to some 350 people, consisting of equal-size groups of Chinese, Hong Kong, and multinational research participants in order to understand how brands can effectively attract, engage, convert and retain consumers.

Attracting Chinese Consumers: Focus on Social & Advertising

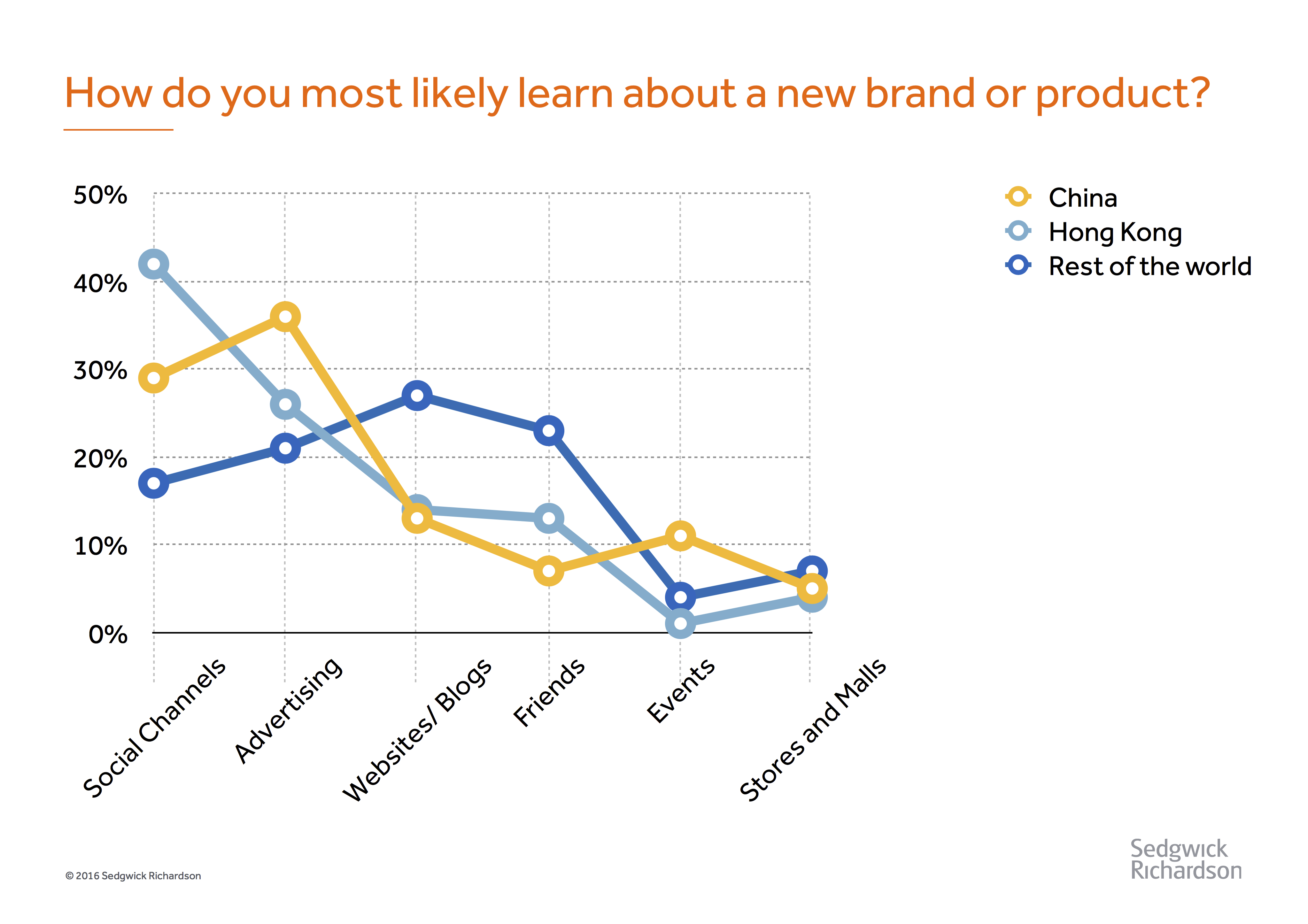

Attracting potential customers is the first step of the marketing funnel. This is where creative approaches and true out-of-the-box thinking have the biggest impact: it puts brands on the map. We asked consumers: “How do you most likely learn about a new brand or product?”

The answers are very revealing: Whereas multinational audiences (“rest of the world”) state that Websites/Blogs and Friends are the most important sources, Advertising is the most common source listed by Chinese respondents (closely followed by Social Channels). Websites/ Blogs and Friends, on the other hand, rank very low.

To people familiar with the Chinese market, these findings are not a big surprise. The results served by search engine giant Baidu, for instance, are viewed with skepticism as organic and paid search results are bundled, thereby making it difficult for users to determine which results can be trusted. Research further shows that traditional event marketing, which is more common in China than in other country, is also a more accepted information source. For Hong Kong, social media is key as more than 40% of all respondents state this is where they find their product or brand inspirations.

Engage On Social By Offering Deals

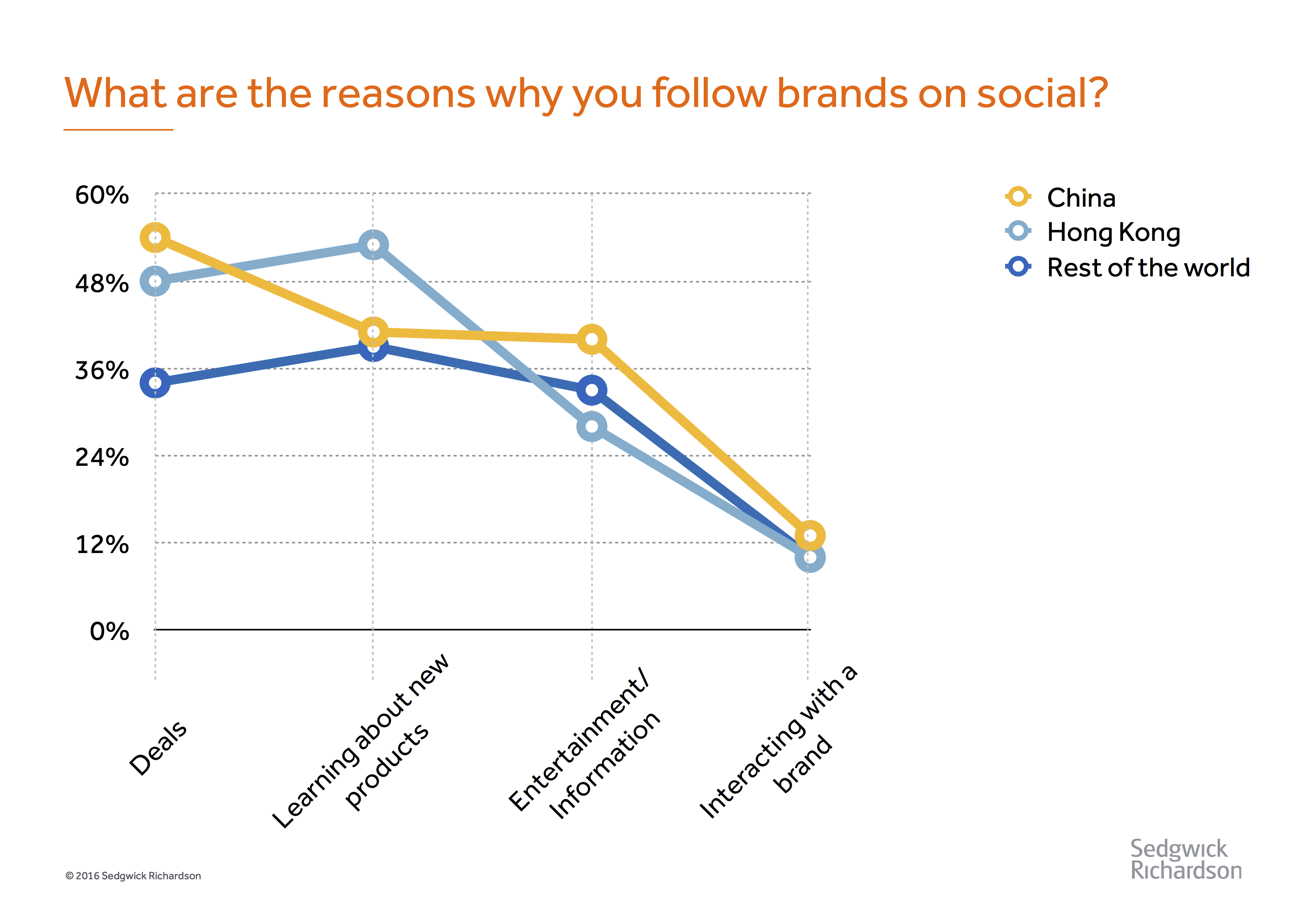

Once consumers have come through the door, it’s important to capture their attention and to influence their decision making. At this stage, social media plays a key role. A brand’s social media followers are by default more likely to make a purchase than people who are only remotely aware of a brand. Also, it’s easier and more cost effective for brands to reach consumers who follow them. The question thus boils down to what kind of information do consumers want to see on social media?

Research shows that Chinese “netizens” are much more pragmatic than consumers based elsewhere: “More than half of all Chinese respondents expect brands to offer them Deals on social media. Learning about New Products and Entertainment/ Information rank second and Interacting with a Brand only matters to 13% of them.”

In other markets, and also in Hong Kong, consumers are less focused on bagging in bargains: only 34% of all multinational respondents state that deals are the key reason why they follow brands on social.

SEE ALSO: China and Global Innovation: Considerations from the Automotive Industry

Product Prices: Chinese Consumers Have Their Own Definition Of ‘Reasonably’ Priced

At the purchase or conversion stage, price anchors are important. A price anchor refers to the amount of money that consumers deem reasonable for a product or service. Consumers often have no way of knowing how much a product or service is actually worth and typically develop price anchors based on past or related experiences. Perfume, for instance, is sold in tiny flasks and can easily cost 200-500 HKD, so based on that market fact, consumers may conclude that 300 HKD is a reasonable price for perfume. 300 HKD is their price anchor for perfume.

In developing markets, consumers have different price anchors than consumers in developed markets. Although in developing markets, price anchors may be lower in terms of totals, they are not necessarily lower when expressed as a percentage of the average income.

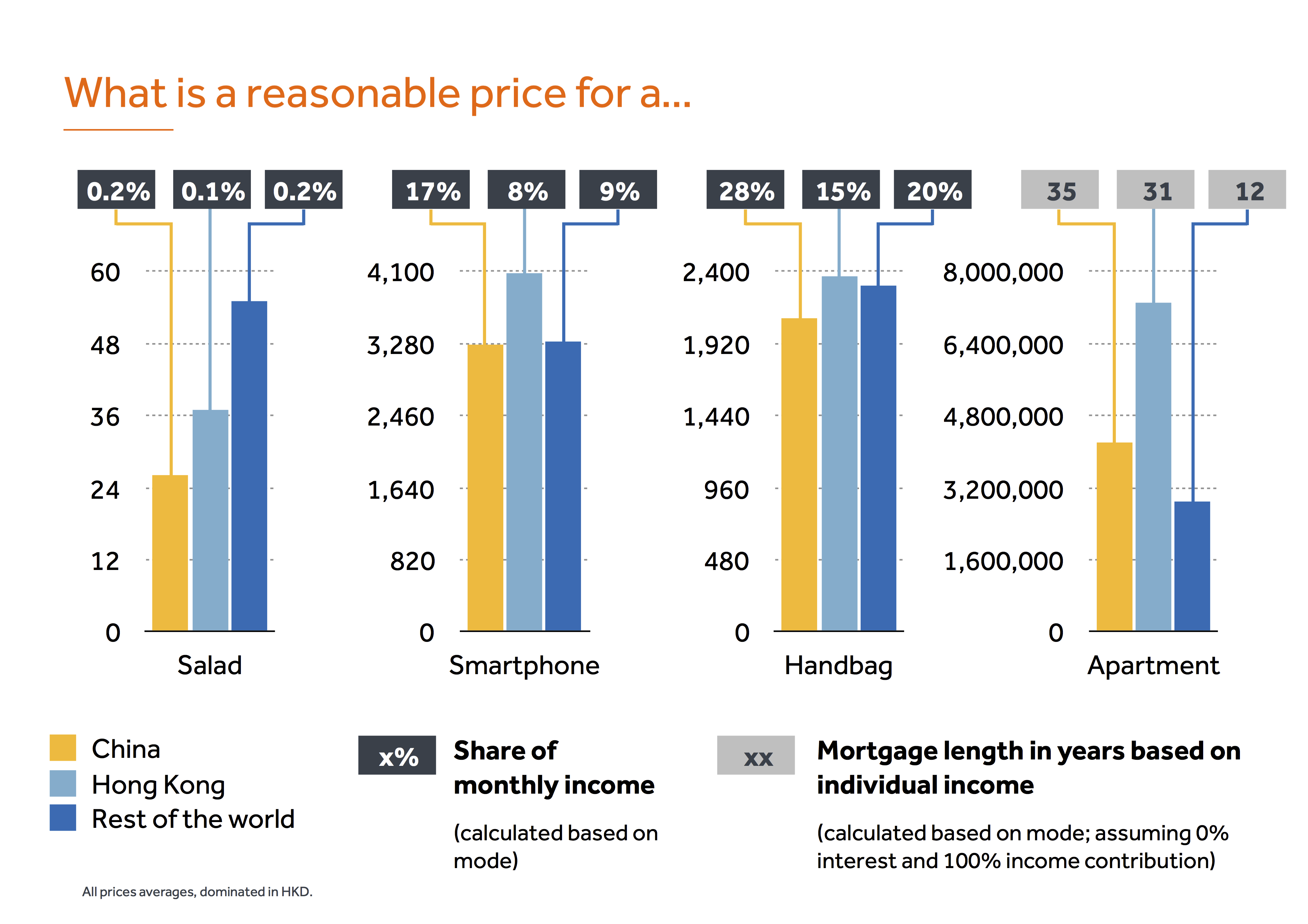

To learn more about price anchors, we asked consumers what their monthly income is and we also asked them to tell us what price they deem reasonable for: a salad, a smartphone, a handbag, and an apartment.

Chinese consumers deem 26 HKD a reasonable price for a salad, compared with 37 HKD for Hong Kong people and 55 HKD for multinational respondents. For smartphones and handbags, Chinese consumers are actually willing to spend almost the same amounts as consumers from around the world.

The average amounts Chinese consumers are willing to spend on a smartphone and a handbag equal 17% and 28% of their monthly income,* significantly more than the share both multinational and Hong Kong based consumers consider reasonable.

For brands these may be good and bad news: Chinese consumers are not cheap, but, on the other hand, they are already spending a big proportion of their income on everyday goods and it is questionable as to whether or not that share is going to increase. The Asian property boom is also well reflected in the anchor prices consumers quoted for apartments: Both Chinese and Hong Kong respondents are willing to pay significantly more for apartments than multinational respondents.

Calculated on the basis of the average income*, it would take Chinese respondents 35 years, Hong Kong respondents 31 years and multinational respondents 12 years to pay an apartment off**. It is mind-boggling to see how far out of proportion property prices in the Greater China region are.

*mode income, based on the data collected through this survey

**assuming 0% interest and 100% income contribution

Are Chinese Consumers Less Loyal? A Myth Debunked Once And For All

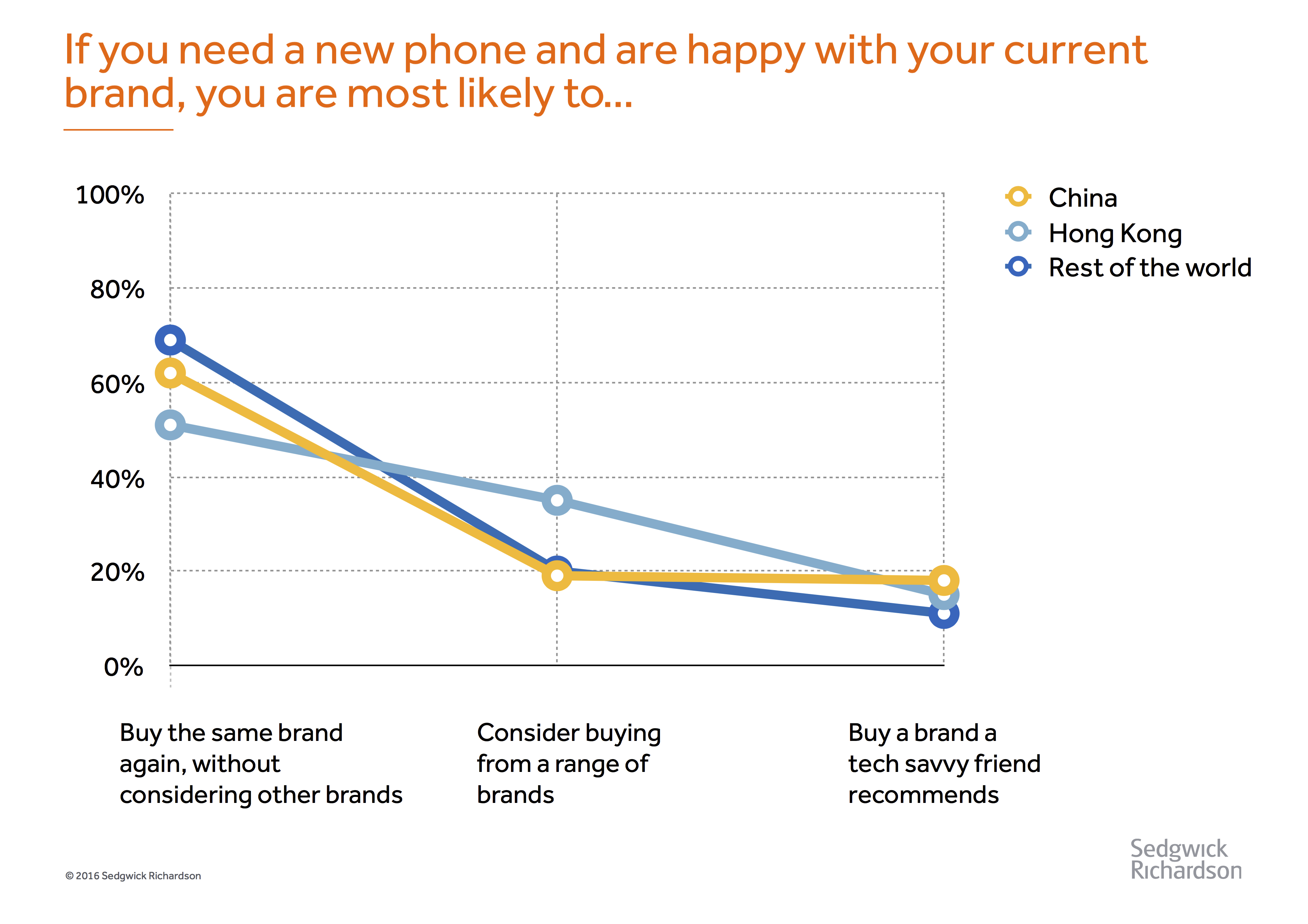

Many articles claim that Chinese consumers are less loyal to brands than consumers elsewhere. In 2014, the SCMP ran the headline: “‘Chinese customers’ lack of loyalty puts pressure on brands” and even McKinsey writes that to Chinese consumers “brand loyalty is often secondary.”

First of all, many of us are probably less loyal customers than we think we are. That’s because loyalty means nothing else than repeat purchases. We may be loyal to a hotel chain if we are getting close to qualifying for that free stay, but in many situations whatever product we bought the last time is not something we are that concerned with. Think groceries shopping: do you always buy the same butter, same shampoo, same soft-drink? Probably not and that may be because your favorite brand is sold out, or maybe you just want a little change.

RELATED: Marketing in a World Where the Most Popular Word Is an Image

In recent years in China, loyalty levels must have been lower than they are in more developed countries. Consider the following: Just about a decade ago many international brands had not yet entered China (or they barely had a foot in the door). When they did enter the market, Chinese consumers were presented with more choices and naturally opted for one of the new brands available every now and then. As a result they became ‘disloyal’ to whatever brands they used to buy before. Launching new brands in any given market segment will almost always mean that the market either becomes more fragmented, or that existing brands lose loyal customers. That is exactly what has happened in China over and over again.

In other words, the remarkable growth that many foreign brands have reported in China over the past few years has largely only been possible because Chinese consumers are, just like consumers in any other country, pragmatic and buy brands that have the most appeal. The difference is that in developed markets, new entrants and new brand launches are less common than they are (or used to be) in China.

Considering these factors we believe that there are no fundamental differences with regard to customer loyalty. The above described catch-up effect caused by more brands entering the Chinese market may still affect brands today, but fundamentally there do not seem to be differences in behaviour.

Mastering New Customer Acquisition is Key To Success

This research indicates that excelling in attracting new customers is key to success in China. Once customers are hooked, moving them down the marketing funnel is less challenging (it is still costly though). Advertising, which appears to be the most effective way of attracting consumers, is tough — in China, channels are messy and competitors have a tendency to be shrill. To be heard, brands have to be loud in the market, but they also need to avoid alienating potential customers. This can be a slippery slope. In the long-run, social media focused strategies may be more effective than more traditional advertising, and especially paid search driven approaches. Social channels are already the second most important source Chinese consumers tap into to learn about new brands and products. This percentage can be expected to grow on the expense of other mediums and channels.

Images: Bryon Lippincott, Sedgwick Richardson