The final whistle has blown in Portugal, leaving fans and analysts alike to dwell upon their teams’ Euro 2016 performance. The same applies to a variety of brands involved in this tournament. Unlike the teams and the players, however, brands don’t have much time to assess their performance before the next big fixture in their calendar: Rio 2016.

The Euro 2016 battle

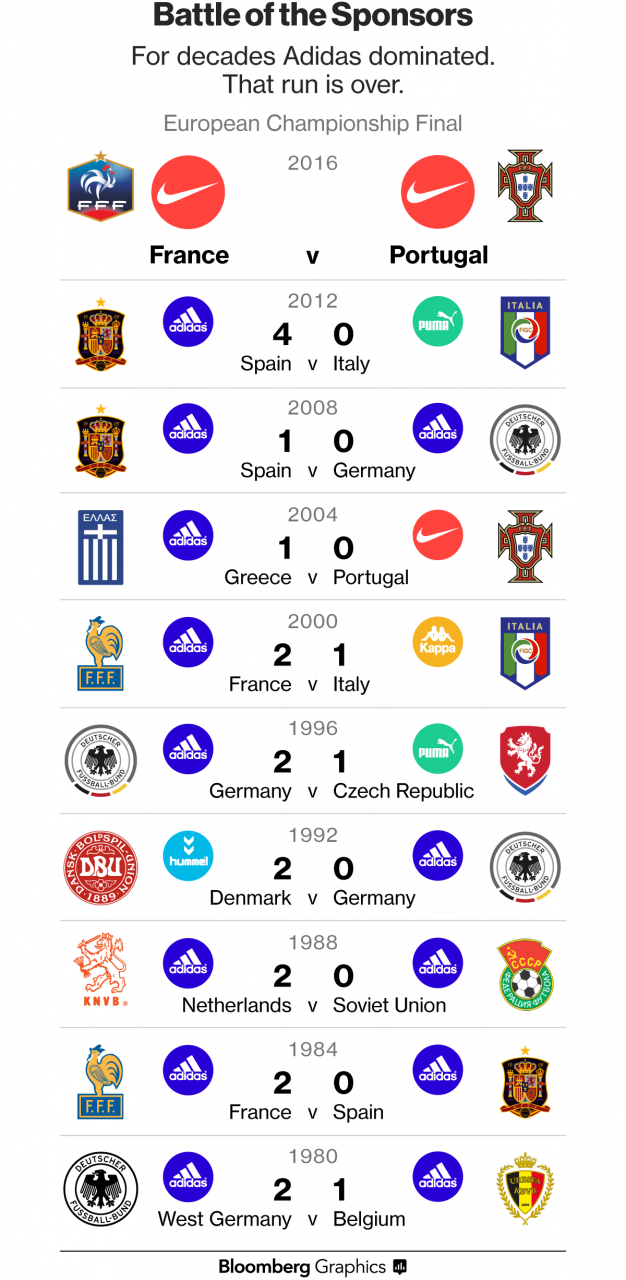

Nike and Adidas have battled in the $5 billion global soccer market since the 1990s, and nothing is more attractive to them than top national and club team jerseys. When it comes to Euro competition finals, for decades Adidas dominated … until recently.

For the first time in three decades of modern sports sponsorship Adidas didn’t have a team playing in the European Championship final, while all 22 jerseys on pitch featured the swoosh logo. The fact that Adidas was one of the official sponsors of the tournament just makes it even worse.

Concerning their clash in social media during the competition, Adidas had to demonstrate a “most shareable brand” award. Focusing its content approach on key assets, federations, and footwear products, Adidas was the number one brand in terms of share-ability. The brand accumulated 1.61m shares across Twitter (retweets), Facebook (shares), YouTube (direct shares and shares to other social platforms), Instagram (user tags), and Online Media (shares to social platforms).

On the other hand, even though only Adidas chose to sponsor the tournament, the numbers suggest Nike “won” the “advertising game” with “The Switch.” The ad featuring Cristiano Ronaldo has emerged as the most shared ad of Euro 2016, according to new data from Unruly (Adidas didn’t even break the top 10).

The six-minute long film counts more than 50 million YouTube views while Adidas’ “Paul Pogba: First never follows” got just over 300,000.

Nonetheless, the true value of the above measurable results lies in engaging and converting the fans and followers into customers. Both brands have ensured that their key sponsorships maximised their reach to a very specific target audience.

Nike is focusing more on the influencers and the players it is sponsoring with Cristiano Ronaldo, its biggest star, and the fact that Portugal not only made it to the final but also won the Cup, being a big win for the brand. Moreover, Nike is already showcasing an impressive online presence and big events help validate the brand’s status among its competitors.

According to Repucom, Adidas has won in terms of engagement and it is a big win to compete with the loyal followers of its big rival. According to a recent press statement, Adidas expects that the sales of its football boots, shirts and balls will rise by 14%, leading to the record number of €2.5 billion for 2016.

The Rio 2016 race

“The Olympic Games are an irresistible opportunity for brands to captivate consumers with sponsorship deals and savvy marketing campaigns that are clever and relevant and will play a major role in generating brand awareness and consumer engagement” says Bernadette Kissane, apparel and footwear analyst at Euromonitor International.

Recently in the past Olympics, Nike has deliberately passed on being an official sponsor, preferring instead to promote their products with innovative advertising and product-placement-tactics mostly referred to as “ambush marketing.” Nike’s Olympic success has come at the expense of their chief rival, Adidas, who has spent hundreds of millions to be an official sponsor only to see Nike win the gold. Now for the Rio 2016 Olympics these rivals have reversed their positions with Adidas opting out of the official sponsor role while Nike has decided to become an official sponsor. Why would Nike, after being so successful during the London Olympics, switch their role?

According to Nike brand president Trevor Edwards, “Sports moments like the Olympics are when Nike brings our best innovations to help athletes redefine what’s possible.” But is that just it?

According to organizers, official Rio 2016 products are expected to generate about $260 million in sales within Brazil alone, with 30 percent of these sales attributed to international visitors. Bernadette Kissane notes that with 80 million Brazilian people claiming to be actively engaged in one or more sports and approximately half of the population is under 30 years old, sportswear in Brazil is a lucrative category.

On the other hand, in the five years leading up to London 2012, the German sportswear giant — which also owns Reebok — spent £100 million (about $139.5m) sponsoring individual athletes and teams. It was also an official sponsor of the Athens (2004), Beijing (2008) and London (2012) Summer Games. Adidas reported selling £100 million worth of Olympics-related merchandise alone in the year leading up to the London 2012 Games.

While Adidas has been displaced by Nike as the official sponsor of the Games, the company will flex its marketing muscle through its sponsorship of France, Canada, Germany, and Great Britain. Adidas has also introduced a special Brazil-inspired soccer ball for the event. Collaborations with local brands are another pillar of the strategy, “One way we’ll be looking to activate this important period for the country will be to work with local Brazilian talent to create products that will resonate around the world,” explains Simon Cartwright, Adidas’ senior director of team sports and Olympics. “Following on from our hugely successful collaboration with [Brazilian fashion label] The Farm Company in 2014, we will be working in 2016 with [swimwear line] Salinas on a new set of performance ranges.”